Now we're going to need a little math. In connection with FOREX, you are certainly already on the terms “Pip” and “Lot” bumped, what we want to show you here is what it is about and how it is calculated. Take some time, because every FOREX trader should know about it. You should not trade before you can calculate profit or loss using pip value.

So what is a pip?

A pip is the smallest unit around which a currency pair can change, usually the fourth digit after the decimal point. So if the EUR/USD rate is different from 1,2250 on 1,2251 increased then we speak of a pip.

Each currency has a certain value, therefore it is also important to be able to calculate the value of a pip for this currency. Currency pairs where the US dollar is the base currency are indicated with only two decimal places, for most other currencies, this is four.

As an example, let's take the USD/JPY pairing and a rate of 119,80. In this case, a pip would be 0,1.

So:

USD/JPY = 119,80

0,01 divided by the exchange rate = pip value

0,01 / 119,80 = 0,000834

That looks like a very small number now., but later we will talk about Lots.

If a currency other than the US dollar is the base currency and we want the US dollar value, then we have to add another calculation step.

Example:

EUR/USD = 1,2200 (a pip is here 0,0001) 0,0001 divided by the exchange rate = pip value 0,0001 / 1,2200 = (EUR) 0,00008196

But we want the pip value of the US dollar, the following invoice:

Pip Value EUR x Exchange Rate = Pip Value USD 0,0008196 x 1,2200 = 0,00009999

We round up 0,0001.

Why we want to calculate back to the US dollar value? For most brokers, the US dollar is the default currency. Maybe you're thinking right now, what do I need this arithmetic for?, all brokers do this automatically for me. It's always good to know, how these figures are created. In the next section you will learn how such inconspicuously small numbers can affect.

What is a lot?

On the FOREX market is in lots (Batch size) traded. The standard size for a lot is 100.000 USD. Some brokers already allow you to do it with lots of 10.000 USD, to trade a so-called mini lot. As you have already learned, currencies are measured in pips, which is the smallest unit in a currency.

To take advantage of these tiny units, you need to trade large sums of a currency to make noticeable profits.

For our calculation example we use a lot of 100.000 USD. Then you will see how a pip affects.

USD/JPY = 119.90 Pip value x lot = change per pip (0,01 / 119,80) x 100.000 USD = 8,34 USD per pip

Expressed in words at the assumed lot size, each pip is 8,34 Worth USD.

If the US dollar is not the base currency, then we have to add a calculation step here again.

EUR/USD = 1,1930 Pip value x lot x exchange rate = change per pip (USD) (0,0001 / 1,1930) x 100.000 x 1,1930 = 10 USD per pip

How do I calculate my profit now??

Example:

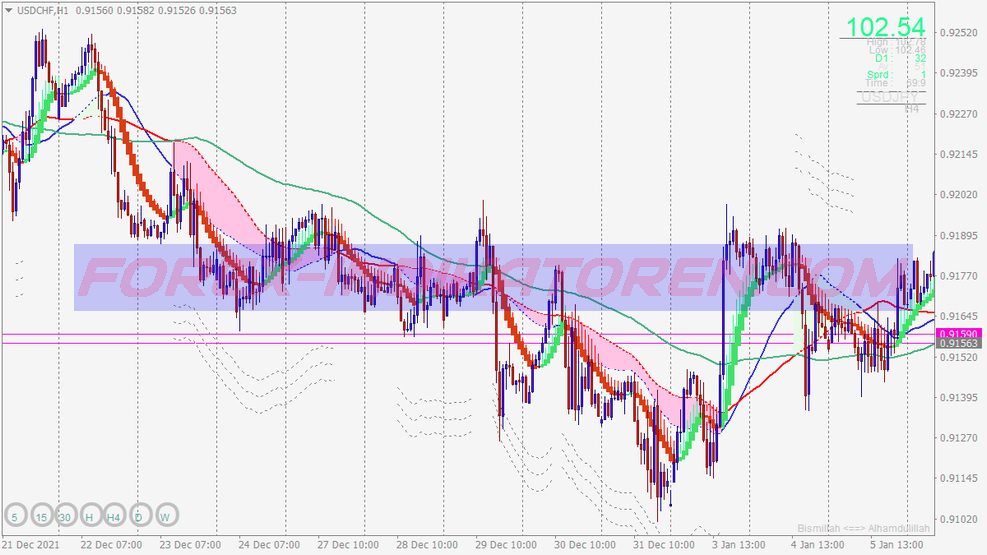

You buy US dollars and sell Swiss francs. The exchange rate currently 1,4525 / 1,4530. Since you are buying US dollars, you use the 1,4530.

You buy a lot from 100.000 USD to 1,4530.

A few hours later, the price increases to 1,4550 and you decide to close the trade.

The new USD/CHF rate is now 1,4550 / 1,4555. Since you bought first to open the trade, sell now to close the trade, therefore, the 1,4550 can be used.

The difference between 1,4530 and 1,4550 is 0,0020 or 20 Pips.

If we use the previous formula:

(0,0001 / 1,4550) x 100.000 USD = 6,87 USD per pip

With our 20 Pips this results in a profit of:

20 x 6,87 USD = 137,40 USD

Remember, when you open or close a trade, the spread must always be taken into account. When purchasing a currency, you use the offer price (Bid), if you sell you have to use the Ask. In other words,, when you buy a currency, pay the spread when opening the trade, when you close the trade you pay nothing more.

Conversely, you should sell a currency you pay nothing to open the trade, however, the spread accrues when the position is closed.

Leverage, What's that?

You may have wondered how a small investor can trade such large sums of money like you. Just imagine your broker as a bank that will give you 10.000 BORROWS US dollars and holds only a small part of it as collateral, however, generally not retained. Sounds too nice for you? But FOREX trading works just like that, if you use leverage.

The amount of leverage ranges from 1:50 until 1:400, However, you have to decide for yourself which factor is right for you. In the beginning, a low leverage of 50 or 100 but highly recommended.

Your broker will require you to have a minimum of equity, this is also known as margins. Some Forex brokers allow accounts with only 25 US Dollar. Once the money is in your account, you can start trading. Your broker will also set a minimum lot size needed for a trade. The amount your broker withholds as collateral, so the margin depends on the leverage used.

What is a Margin Call?

In the event that during a trade the price drops so much that the losses would be greater than your bet, then the broker automatically closes the affected position. This serves as security, so you can never lose more than your first bet.

The different types of orders

The term order (Order) means the operation to open or close a trade. Now let's talk about the different ways an order can be executed. Depending on the broker, several options are offered.

Here are the basic order types, which can be found at most brokers and some special forms.

Market Order

A market order is an order to buy or sell at the current price. Example: the EUR/USD exchange rate is at the moment 1,2140. If you want to buy at this price, then click on buy and your internet platform will immediately execute the purchase order at the current price.

Limit Order

A limit order is an order to buy or sell that is to be executed at a certain price. Such an order contains two variables, Price and duration. Example: the EUR/USD rate is currently 1,2050. You would buy the pair if the price 1,2070 reached. You can sit in front of your screen and wait until the course at 1,2070 Arrives, so that they can then click on Buy. The second option is a limit order on 1,2070 to set (Afterwards you can enjoy your dinner or whatever else you like). If the course is the 1,2070 achieve, your Internet platform automatically executes the purchase order.

Stop-Loss Order

A stop loss order prevents larger losses, should the price develop against your forecast. For example, you buy EUR/USD for 1,2230 (Long- Position). To limit your maximum loss, insert a stop-loss order 1,2200. In the event that the price falls and the 1,2200 reached, Your trading platform automatically closes this position and prevents you from doing more than 30 Lose pips. This type of order is very helpful if you do not want to sit in front of the screen all day because you are afraid, to lose everything.

Take Profit Order

Variant of a limit order, offered by Forex brokers. Especially with highly volatile currency pairs, it is helpful to define a goal, by closing the position again. In the event of fluctuations, there is always the risk that the price will move in the other direction again. With a Take Profit order you take the achieved pips with you and close the position with a profit, no matter how the course behaves afterwards.

For the sake of completeness, three other order types should be mentioned.

GTC (Good til canceled)

This order remains active on the market until you decide to close it. Your broker will not intervene. So you are responsible for it yourself., that the order is closed.

GFD (Good for the day)

The position remains open until the end of the trading day. Since FOREX is a 24- Hours market is you need to check with your broker when his trading day ends.

OCO (Order cancels other)

An OCO is a mixture of limit and stop-loss order. Two purchase options are defined one over the other below the current price. When a job is executed, the second one is deleted. Example: The EUR/USD rate is set at 1,2040. You would buy should the price on 1.2095 climb, because you speculate that the trend will continue, or sell if the price is below 1.1985 falls. So you're using an OCO. One of the purchase options Meets, the order is executed, the other option is automatically deleted.

You should always check with your broker, which order types can be executed and whether overnight fees (Rollover) if a position remains active beyond the current trading day. My tip, keep your order execution as straightforward as possible.

Summary

In general, you do not need more than the base order types (Market, Limit, Stop Loss- and Take Profit Order). It is important that you rightly set a strategy when acting. Even if you are offered various possibilities to carry out an order, keep everything simple, so you don't lose track.

You should only then trade with real money, if you feel familiar with the features of your trading platform.