This chapter should give you an idea of it, what a trading system should look like and what you need to look out for when developing your own trading system.

My “It's that simple” Trading

Trading Setup

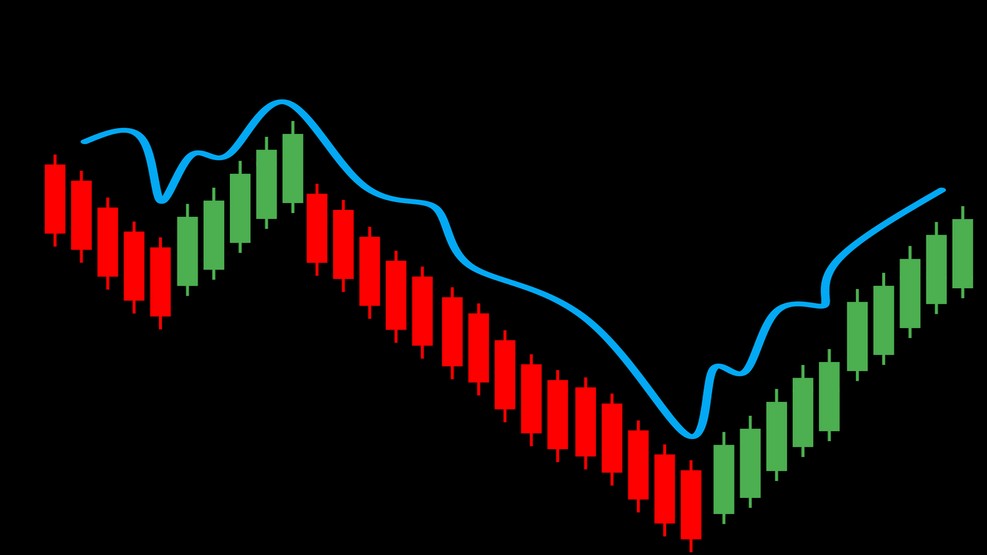

- I want to work with daily charts (Swing Trader)

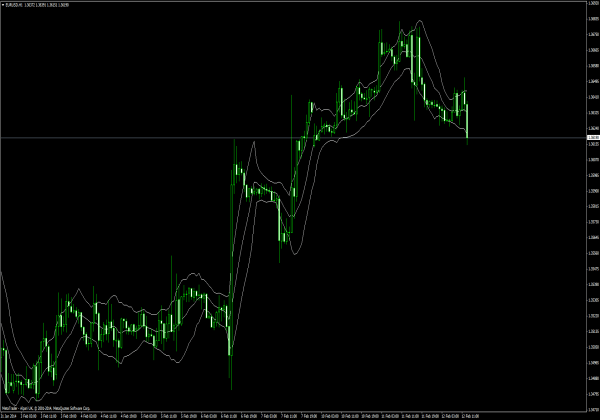

- I'm using a 5 EMA and a 10 EMA for closure

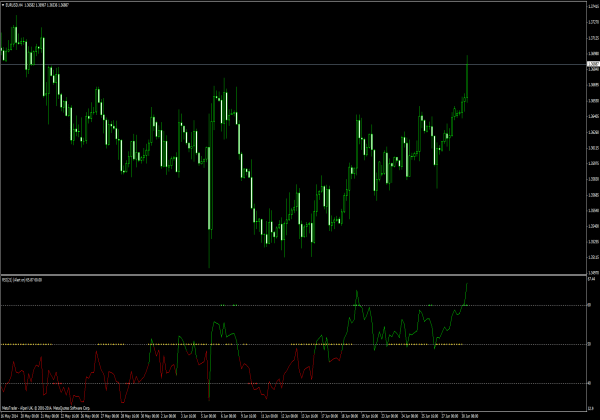

- Stochastics (10, 3, 3)

- And RSI (14)

Trading Rules

- Stop loss at 30 Pips

Getting Started Rules

Buy if:

- The 5 EMA the 10 EMA line exceeds and both stochastic lines tend upwards (we don't get in, if the Stochastic lines are already overbought- Area are located)

- RSI is higher than 50

Sell if:

- The 5 EMA under the 10 EMA line falls and both stochastic lines trend upwards (we don't get in, if the Stochastic lines are already oversold- Area are located)

- RSI is lower than 50

Exit rules

The position is closed, if the 5 EMA the 10 EMA line crosses in the opposite direction of your trade or the RSI back on 50 Returns.

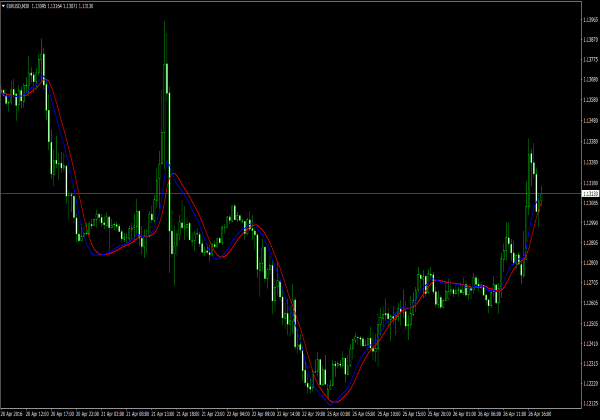

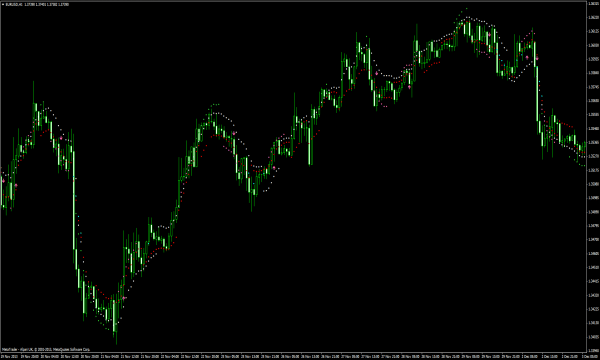

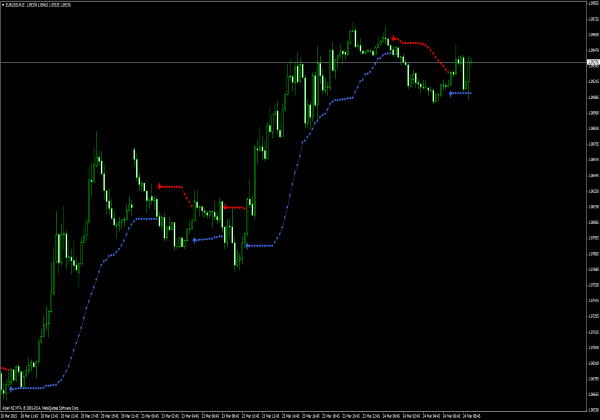

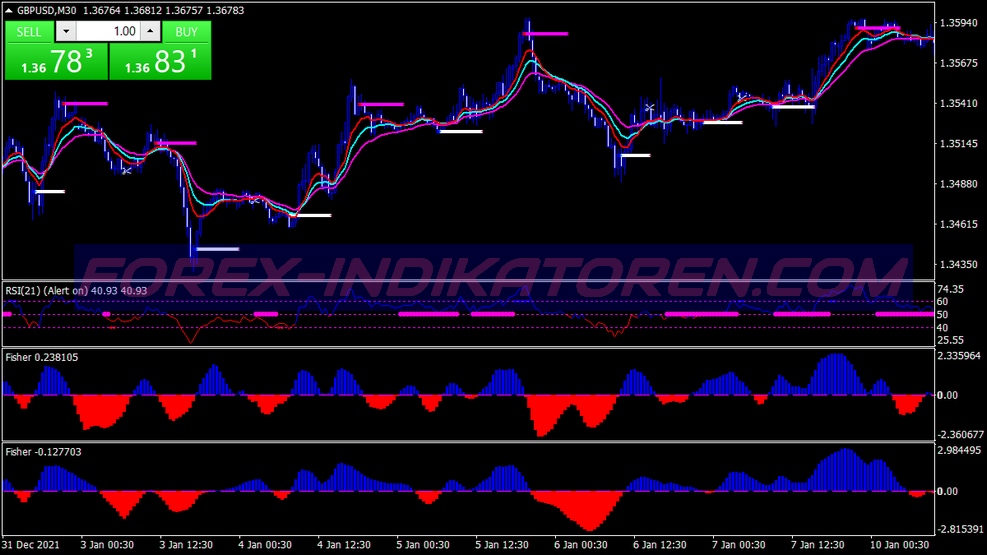

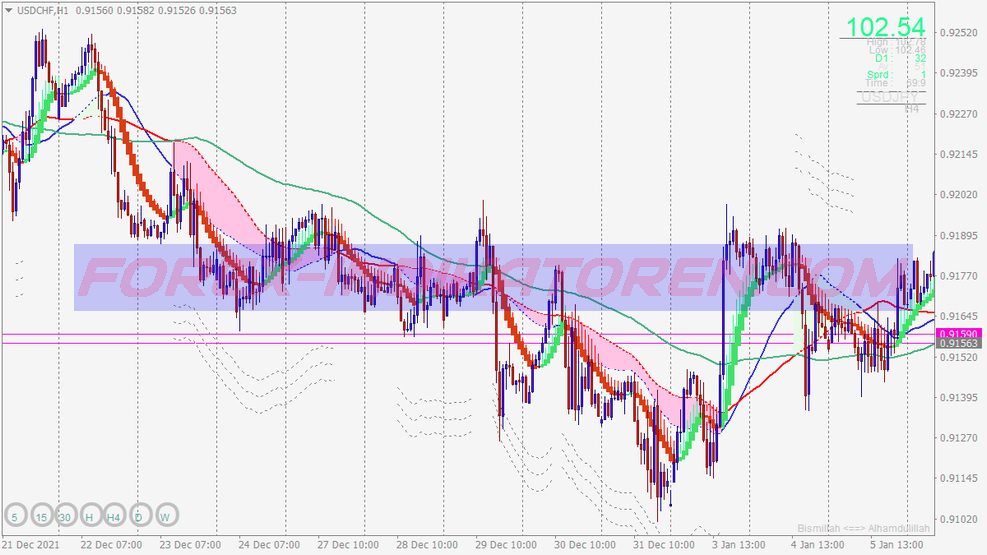

OK, now let's look at some charts and see how the system works.

Test trading system

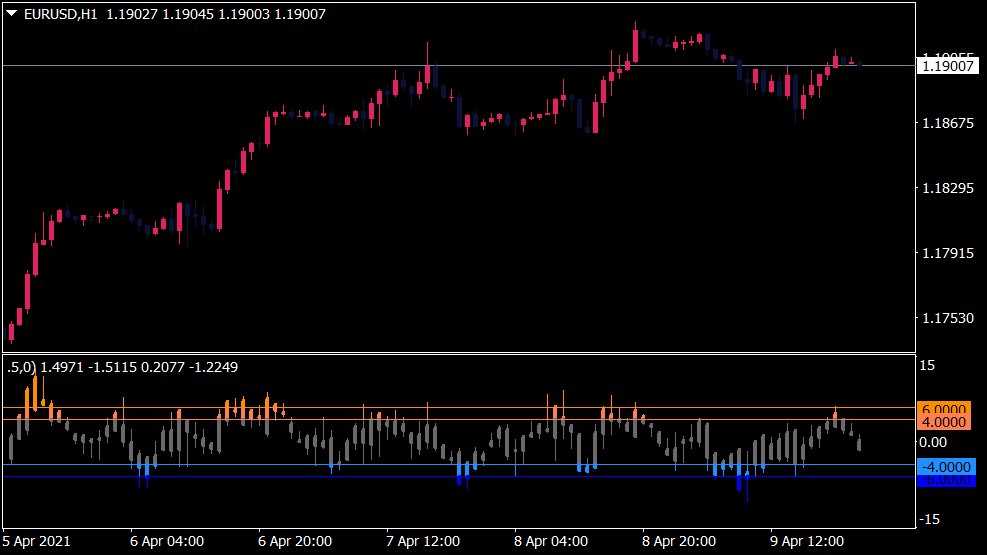

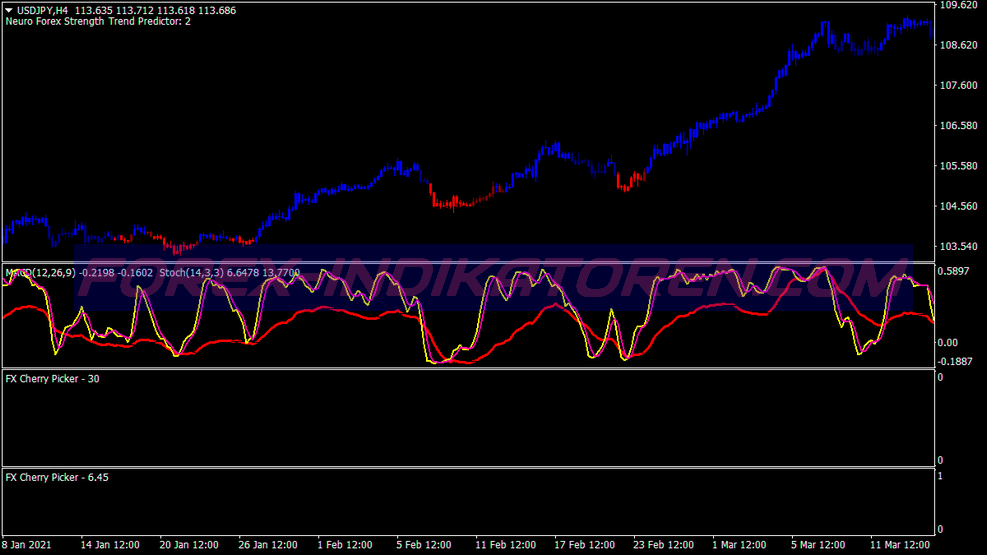

As you can see, all components of a good trading system are included. First of all, we decided, that this is a system for swing trading and we work with a day chart. Then we use moving averages to identify new trends as early as possible. Stochastics help us decide whether to follow the Moving Average Crossover, still a smart idea is to get in and leave us even overbought- and detect oversold sections.

The RSI is an additional confirmation and we get a statement about how strong the trend is.

After we set our setup, we determine the risk of a trade. With our system we are ready 30 Risk pips on every trade. Normally, the larger the time frame, the more pips you should be willing to risk, because the targeted profits for larger time frames are also higher than if you trade with a smaller time frame.

Next, we clearly have our- and exit rules defined.

Now we come to the test phase. Here are some examples:

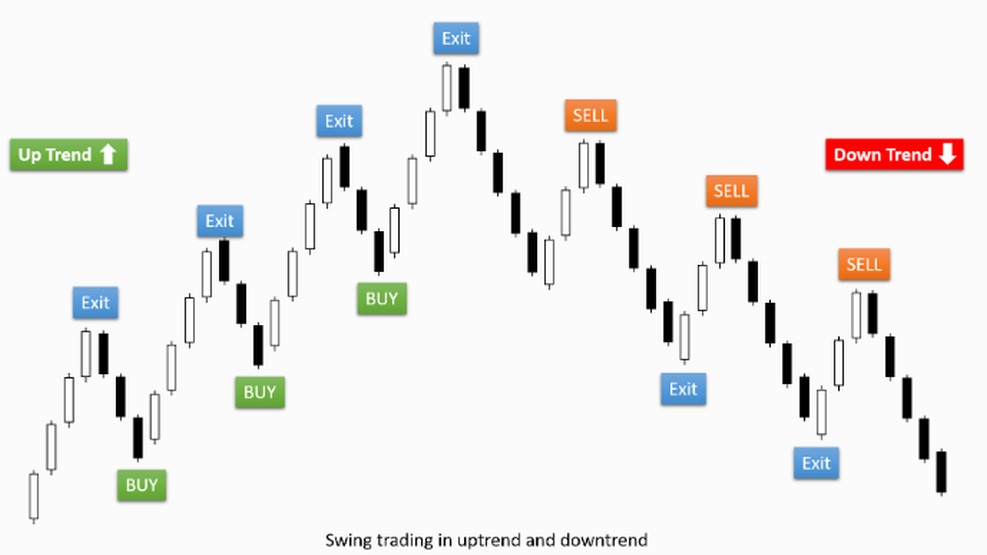

If we look at our chart, let's see that now is a good time to buy, taking into account our rules. To test, note the price at which you buy, Stop- Loss and exit strategy. Then we go further in our chart and see how our trade would have developed.

In this case,, if you had massive pip- Profits achieved. With this trade you could have bought something nice! We also see, when the Moving Average lines intersect in reverse, it would have been a good time to close the position. Certainly not all your trades will go so ideally. Some will be short and ugly, but you should always remember to stay disciplined and follow your trading rules.

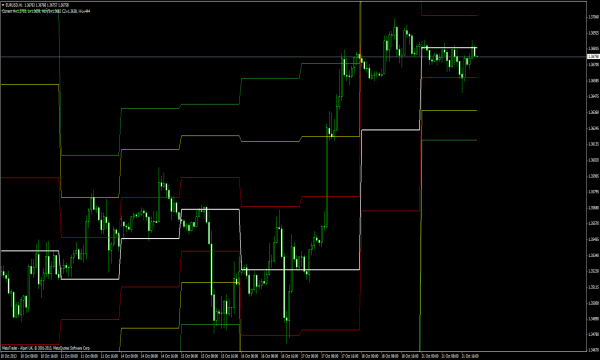

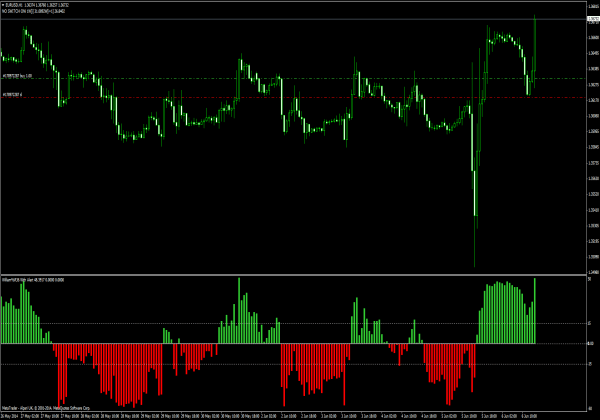

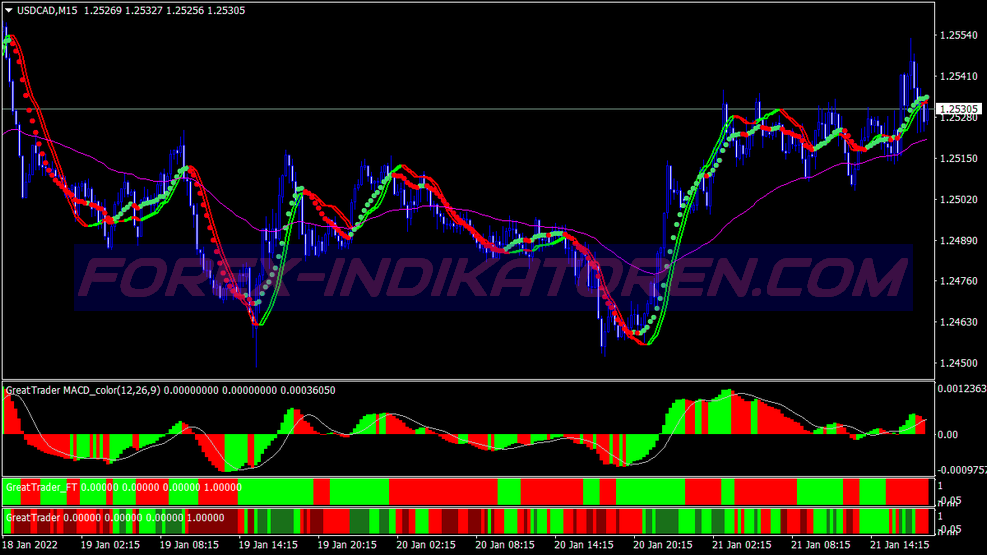

In this example, our criteria are met and we would sell here. We note the entry price, Stop- Loss and exit strategy, then we go back up our chart to see what happens.

Not as great as before, but it happened again what we expected. You can see that we would have held the position until the moving average lines crossed again and the RSI on 50 would have come back.

You may be thinking that this trading system is too simple to be profitable. The truth, it's actually simple. But you should not be skeptical, just because something is simple. KISS is the abbreviation for a rule of thumb of trading systems and stands for “Keep It Simple Stupid”.

What I want to say, Trading systems don't have to be complicated. You don't need, 50 Indicators on your chart. In reality, you save yourself a lot of headaches, if you keep it simple.

But the most important thing is discipline. I can't stress it enough, therefore again:

ALWAYS ADHERE TO YOUR TRADING RULES

If you have tested your system on your demo account for a long time, then you should feel. Because you know, that as long as you follow your trading rules, you will win, not always but more than you lose and that's what matters.

Summary of trading systems

- Your system should be able, Identify trends as early as possible.

- The system should be capable, To protect you from fluctuations (Trend Confirmation).

To long if your system is profitable, test it in the demo account for several weeks. This gives you a feeling for which market situations your system works best in. Have you put the system through its paces and you are sure that it is profitable, then you are ready to trade with real money. Only important is, that you always follow your rules.

You need 6 Steps to develop a trading system:

- Find the right time frame.

- Choose indicators that help you identify trends early.

- Find indicators that protect you from fluctuations and confirm the trend.

- Define the risk.

- Insert- and exit conditions fixed.

- Write down the rules of your trading system and always stick to them!

Testing the trading system

- View charts, find points on which you would have opened a trade and then see how your trade, in compliance with your trading rules, would have developed. Write down key data of the trades to determine if the system is profitable.

- When it's profitable, test your system in a demo account for a longer period of time. This gives you a feel for how you can use your system in different market situations, be able to trade.

- If you have tested your system in the demo account and are still making a profit, then you are ready to trade with real money. You just have to keep it in mind, that you must always follow your rules, no matter what happens.