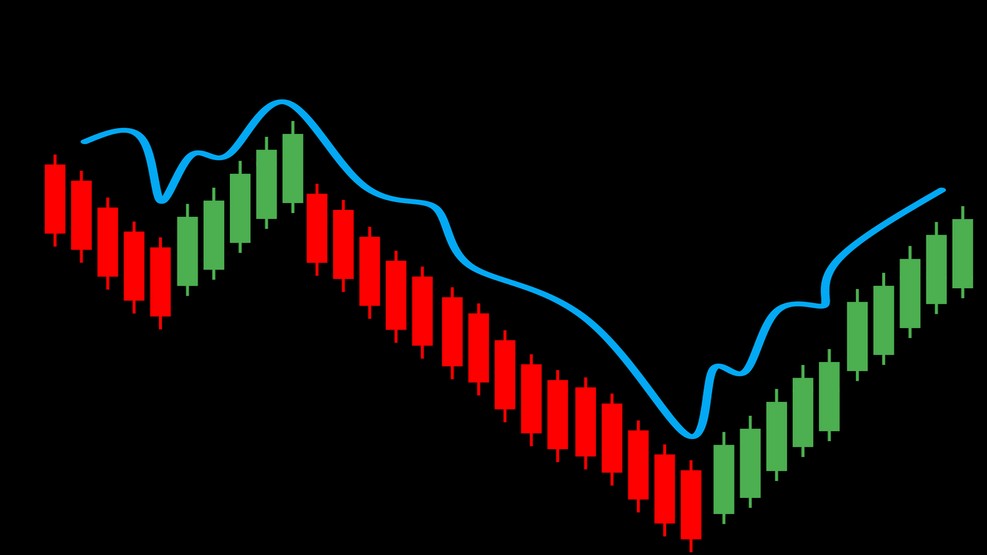

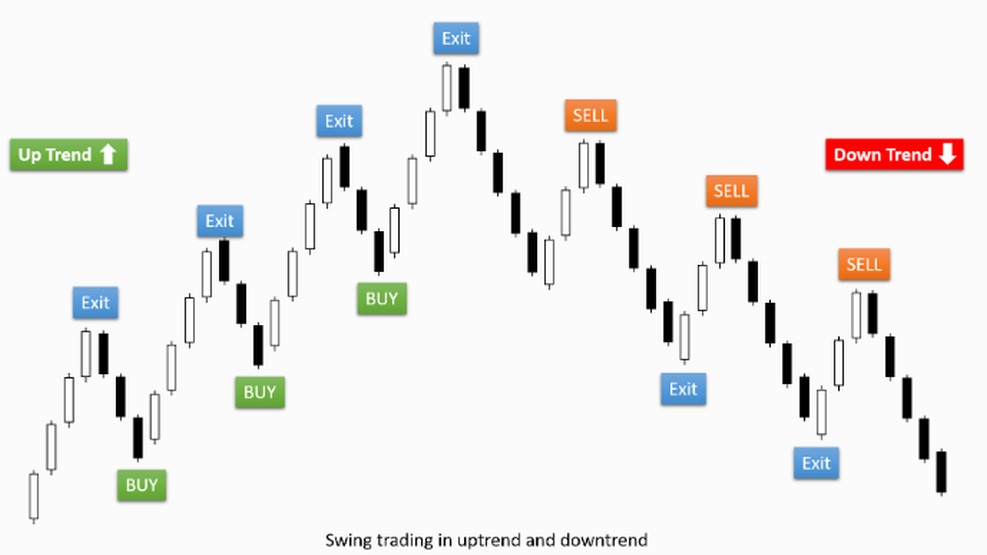

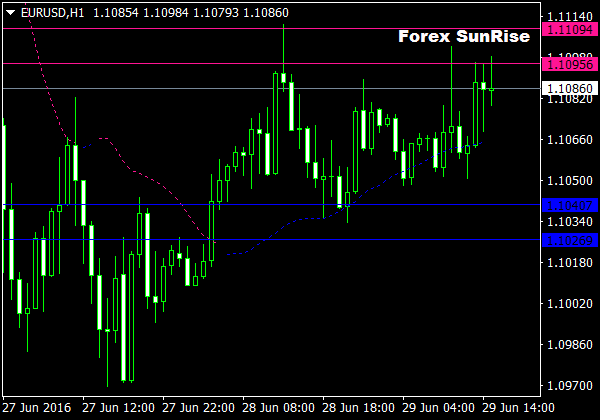

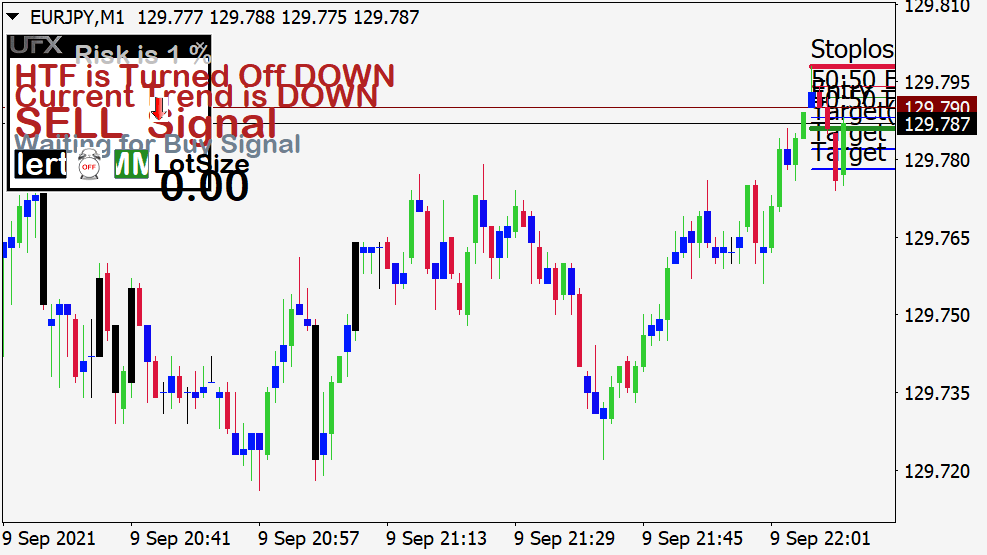

As a trader, a big part of our work is, assess whether prices are rising or falling, whether overbought or oversold conditions prevail, to plan our trades for the current conditions. How do we do it?? What tools can help us? And how do we react to certain conditions?? This is exactly what we want to find out in this chapter. We will deal with sentiment analysis in the FOREX market.

There are basically two different methods of assessing the prevailing conditions, the Technical- and Fundamental Market Analysis. We have already talked about the most common indicators of technical analysis., you are certainly already an expert. But what about the fundamental tools?? What fundamental analysis tools are available to us to assess market conditions??

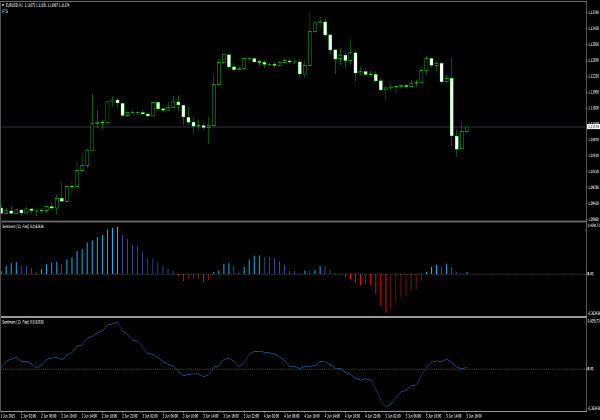

In stock trading, sentiment can be measured by trading volume. Since there is no centralized marketplace in FOREX trading, the volume cannot be determined accurately. Where do you get usable numbers now? This is where the COT report comes into play.

The Commitment of Traders Report

History of the COT Report

The first Commitment of Traders Report (short COT-Report) was launched on 30. June 1962 for 13 agricultural raw materials published. Politicians at the time wanted to provide the public with up-to-date and basic data on the futures market. The figures for this report were completed on the last day of each month and were completed on 11. or 12. Day of the following month published.

Over the years, has been constantly trying to inform the public even better about the futures markets. The “Commodity Futures Trading Commission” (CFTC for short) improved the COT report in several respects:

- The report has been published more often. 1990 the report already appeared in the middle of- and end of the month, 1992 then every two weeks. Since 2000 the COT report is published weekly.

- The COT report was published faster and faster. Initially, 11 Calendar days elapsed between closing date and publication, today it's just 3 Days.

- More information is included. For example, data on the number of traders in each category has been added..

- Last but not least, the report has become more accessible. Initially, the data was distributed by post for a fee.. Today, the reports are available free of charge to everyone via the Internet.

What does the COT report contain??

For both traders and analysts, the COT report is (Commitment of Traders) one of the most important analytical tools. Opinions about his statement are highly scattered. Some claim that commercial traders provide the only reliable clue, while others think only the non-commercial traders are right. Since the report was published, there is also the group of skeptics, they claim that the COT report is being manipulated. Although I don't want to categorically exclude anything, I assume, that the figures correspond to reality, and that it is up to us to work out the data that is important to us.

The COT report is published weekly and contains current figures for all current positions, the (Commodity Futures Trading Commission) comply with limits for the respective market, or. exceed these. Positions, which do not reach or exceed these limits are also recorded, but are assigned to the different types of market participants.

Market participants can be divided into two types, the commercial (Commercial) and the non-commercial (Non Commercial) Trader.

Furthermore, market participants can be divided into three categories., the commercial (Commercial), the non-commercial (Non Commercial) and the undeclared (Small Traders) Traders.

Non Commercial Traders

At the Non Commercial Traders (non-commercial market participants) are institutional speculators. This group consists of traders who try to make profits through speculation. In general, these are large funds or foreign brokers.

Most of them are trend followers, which are looking for speculative profits.

Commercial Traders

Commercial Traders (commercial market participants) are usually companies whose task is the production or processing of a raw material.

These include, for example: 90% pure hedging business (Hedges). Profits are usually not made on the stock exchanges, the costs of this type of protection are transferred to the consumer.

Small Traders

Items not displayed are those that do not exceed the reporting limits. These small positions are not noteworthy. We, the private traders, are among the small traders.

What data does the COT report contain??

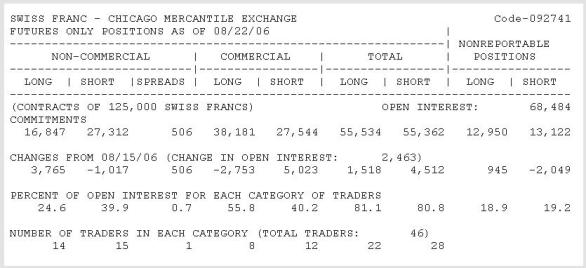

From this table we can find Long- and short positions see those of Non Commercial, Commercial and Nonreportable (Small Trader) Traders are held.

Open Interest: shows the number of contractions that have not been executed or deleted.

Non-reportable Positions: these are the open positions of traders, which are below the limits of the CFTC.

Number of Traders: Number of traders required to be considered by the CFTC.

Reportable Positions: Number of options and futures positions required to be considered by the CFTC.

In the middle of the report we see the point “CHANGES FROM 08/15/06.” Here we see the differences compared to the previous week.

The current report and reports of the past can be accessed free of charge on the Internet at www.cftc.gov. However, in raw format, only experienced traders can interpret these numbers.

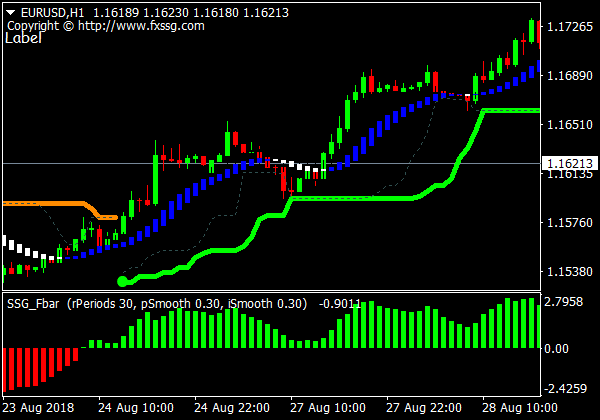

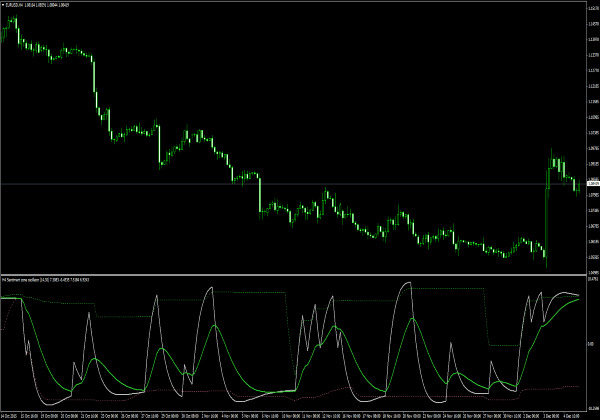

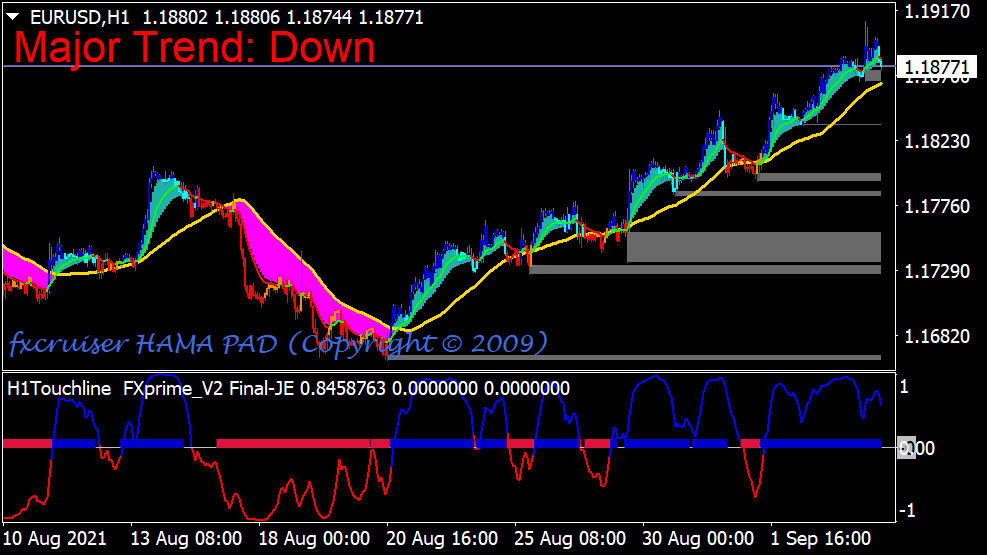

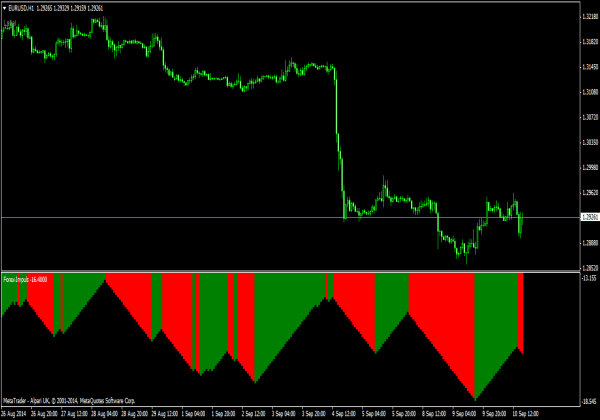

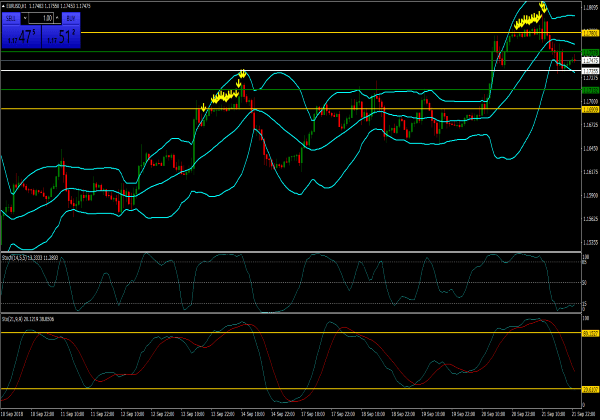

Technical indicators, which are derived from the price in their ability, Be able to reliably predict important turning points, limited, since the upcoming price development is derived with the help of data from past market situations.

In the long run, the market will take the path that fundamentals dictate to it., as changing fundamentals determine traders' activities.

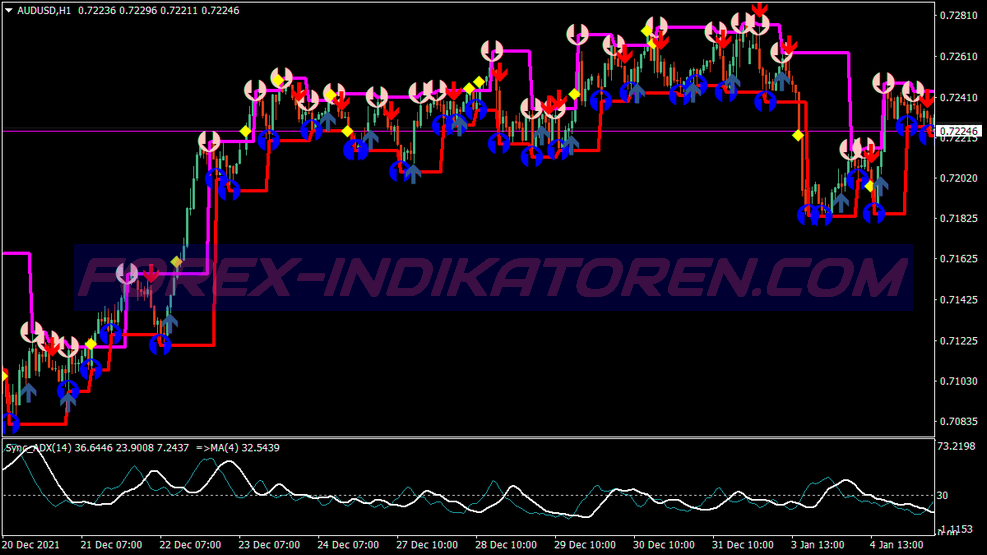

Price behavior is a reflection of the activities of all traders. One way to estimate the price development is to track the activities of the traders. Since prices on the FOREX market are determined by buyers and sellers, can be indicators, based on traders' activities, Provide insights into future price developments.

The exact analysis of the activities of the traders reveals, how these traders interpret the fundamentals. Position sizes and whether positions are opened or closed, can sometimes provide information on how market participants assess the market situation.

The data of the COT report enable the trader, track the activities of market participants in the respective market. The indicators, derived from this information, offer the trader a unique insight into the market, with the help of indicators based on price, is not possible.

Congratulations

With this you have gained the basic knowledge to start as an intern on the foreign exchange market.

Don't expect to get rich right now because you know: Apprenticeship years are not master years! If you haven't already, you should definitely download a broker's interface now and apply your knowledge!