There are many different FOREX traders. Every trader is an individual, has its own schedule, Risk, Commitment or capital framework. Some traders have several good features, others get along well with a strong side. What I want to say, every dealer is unique. Your personality, Preferences and situation during trading, are factors that determine how successful you are.

To find out how you should trade, you must first find out your own "trader personality". Your trader personality determines your trading style and methods that suit you. In contrast to a T-shirt, there is no universal size when trading that fits everyone.

I now call on you to self-assess your personality, Behaviour, Faith and thoughts on. Think you're disciplined? Are you reluctant to take a risk or are you willing to take risks? Are you rather undecided or spontaneous? Patient or you can't expect anything? Would you rather go for bungee jumping or a museum? Do you like your martini shaken or stirred?

Keeping a logbook can help you with self-assessment. You can analyze the processes after trading and thus find out your strengths and weaknesses while trading. Recognizing your personality is one thing, but figuring it out while trading is a completely different matter. A trade- Logbook offers you a review of your successful and less successful trades and sometimes shows the reasons why some trades were successful and others were not.

Types of Trader Personalities

Before we talk about your trader personality, let's look at the profiles of three other people. We will look at the situation and preferences of these people and how their way of acting is reflected in real life..

Peter the Position Trader

Peter is a very busy man with a demanding woman, four children, two dogs and a hamster family. It would be impossible to provide for such a large family with no salary. Luckily, Peter is a successful doctor.

He can't and doesn't want to sit in front of the computer all day. But he likes to read world economic reports, he has a short list of countries whose economies he keeps a close eye on.. Peter prefers positions- Trades. This means, when he opens a trade, then he holds the position from a few weeks to several months. He trades only a few times a year. Most of the time, at the end of the year, he can count his trades on one hand.

The basis for this way of acting, for Peter, fundamental analysis and his own assessment of the market situation. He spends one or more hours a week reading economic reports, to see what signals the economy is giving him for his trades. After that, he decides in which direction he acts, what is not always automatically the direction that the signals show him. Since Peter's trades are generally scheduled for a longer period of time, his profit targets are high, but also his stop- Loss Limit. His stop- Losses move between 100 and 500 Pips, while the profit targets are between 500 and 1000 Pips, sometimes even more, move. His trades have a high reward to risk ratio, which allows him to minimize his losses if he is wrong and gives him high profits when his forecast occurs.

Peter enjoys a position- Being a trader, because it allows Him to live His life, with all his work and family obligations. He would never have the time a day trader would need. His trader personality does not demand of Him, Make decisions in the heat of battle, but allows him to plan his trades over a longer period of time. As positions- Trader gives him more time for his work and family.

Sebastian the Swing Trader

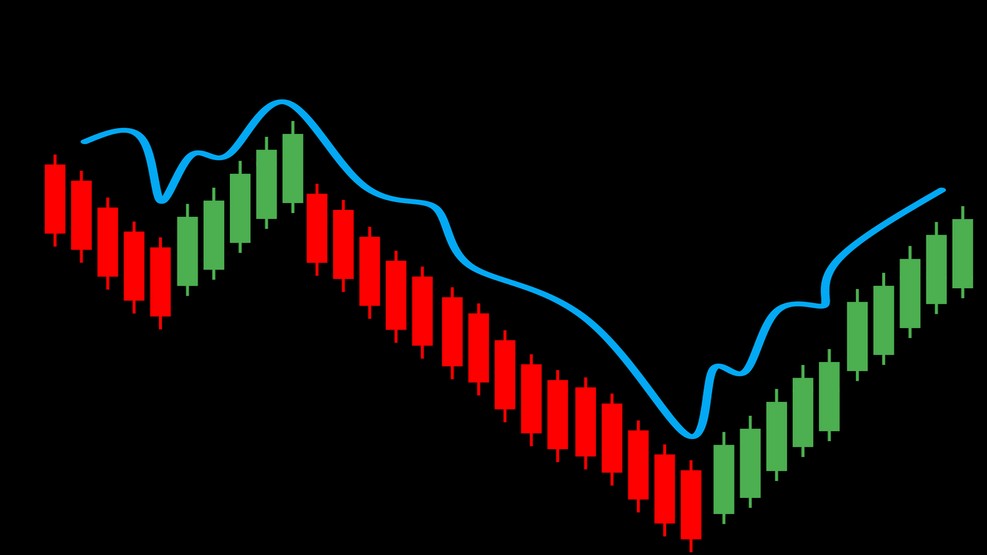

Sebastian is a single, who has a small bistro around the corner, where he works part-time. He has been a FOREX trader for a long time. Currently, its schedule allows it to watch the market for an hour or two a day. Sebastian prefers to hold his positions over a much smaller time frame, as the Peter of Positions- Trader does. He tries to take advantage of short-term movements in the price of a couple, he wants to hold his positions for at least one day or several days, to give the price movements some time and to catch additional impulses. On some trades, Sebastian keeps the position open for up to a week.

Sebastian spends an hour a day studying the market. The first half hour he reads the important economic news of the day and what economic data will be published in the next few days. Based on what is happening worldwide, decides whether his preferred currency pairs will show volatility or not. Since he only observes two or three currency pairs, he does not need much time to read the most important reports.

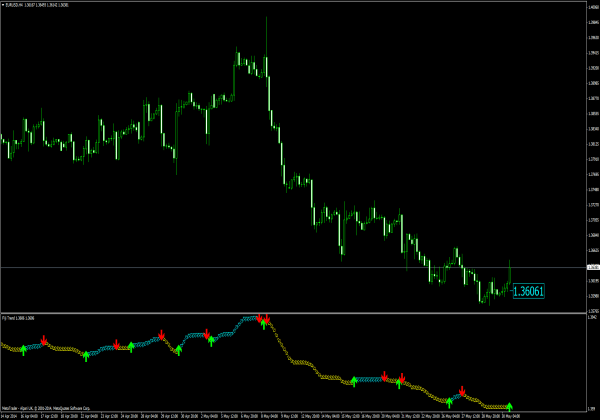

After Sebastian read the economic news and reports, he decides whether the market will move in the next few days or weeks or rather not. Now he picks up charts and uses technical analysis to find the right time to open or close the FOREX trade. To find support and resistance levels, Sebastian uses channels, Trend lines, Moving averages but also other tools. Now he sets limit orders with stop- Loss and profit targets, after that, the Ein passes- and exit practically automatically.

Sebastian is very successful. Its losses are due to 50 until 100 Pips restricted, while its profits vary between 100 and 500 Move pips.

Normally Sebastian looks for his positions once or twice a day to make sure that unpredictable events have a decisive influence on his positions.. The rest of the day Sebastian does what he is doing right now, work, meet with friends or whatever else is coming up.

Doris the Day Trader

Doris is extremely impatient and has the feeling that she always has to do something. Your trading style is to hold positions for a day or less. Some days you only trade once. On others, you trade several times before the market closes. At the end of the trading day, it closes all your positions. As a day- Traderin believes Doris that she should constantly monitor the market, so that you do not miss out on good trading opportunities. She is rather risk-averse and does not want to lose too much on a single trade, therefore the stops are- Loss limits very tight.

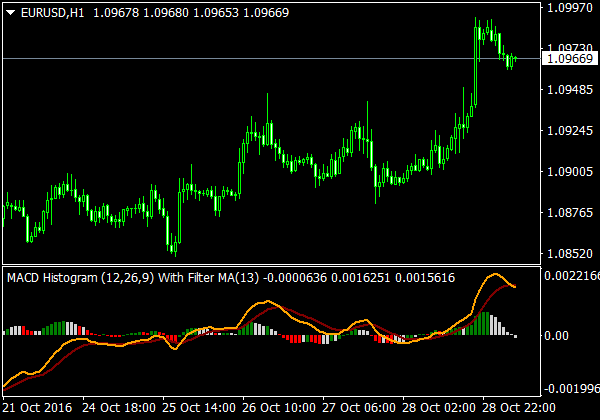

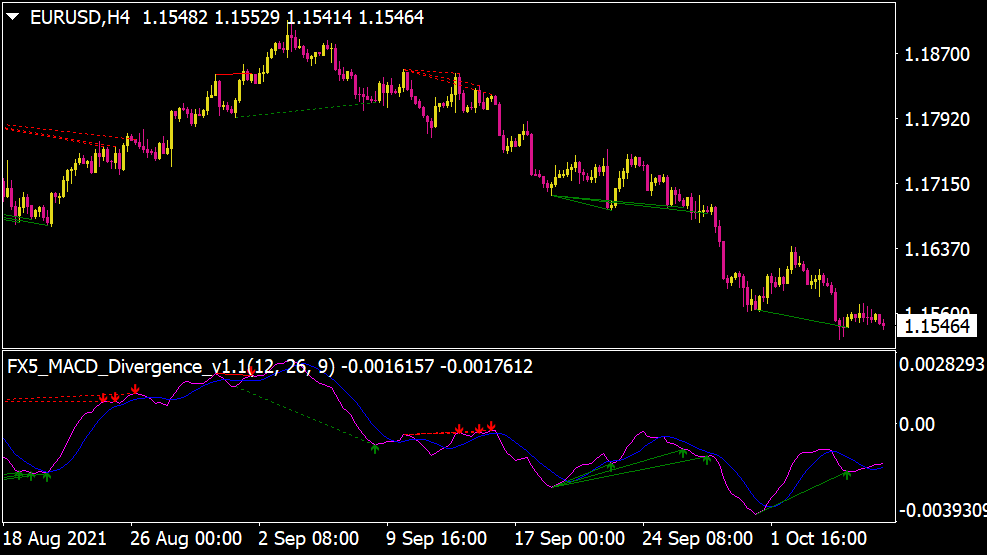

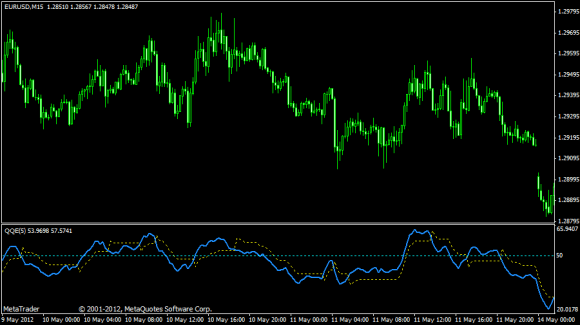

Doris has been working for years on her method of making profits on the market. Your capital is big enough, She quit her job to watch the market all day. Although she reads economic news every day, Doris prefers to rely on technical analysis when trading FOREX. It uses technical analysis tools such as.B. Oscillators (MACD, RSI, Stochastic) and Moving Averages, which gives you the times to enter- and signal exit. Doris always follows these signals.

Mostly Doris makes 10 until 50 Pips while you reduce your losses 10 until 20 limited, often scalps you also the market. Scalping is a method in which larger lots are traded and few pips are taken from the market (normally 5 until 10). Most of your scalp- Trades only take a few minutes or even seconds!

The Day- Trade and scalping methods allow Doris at least one or even several trades daily, this satisfies your constant need to do something. Doris can rely on your trading system and she invariably follows its rules. She does not have to decide whether she should open a trade or not, this is done by the charts. Doris knows your system is not perfect. She loses something 40 Percent of your trades, but your average profits are about three times higher than your losses. over a longer period of time, you always make a profit. Doris can now work from home, is your own boss and can choose your days off yourself.

Which way of trading suits me?

To answer this question, you should first ask yourself the question, “How much time do I have to trade currencies on the FOREX market and how long do I want to hold my positions?”

We can distinguish different trader personalities based on the time frame. Look at these different styles and determine which one suits you best.

Scalping

Scalpers are traders who work in very small time frames, often there are between a- and exit time only seconds. Most FOREX traders reject this type of trading. There is a high risk, since many lots have to be traded in order to generate a reasonable profit from a few pips. So not for the faint of heart or small purses.

Daily Trader

Day traders open and close their positions during a trading session.

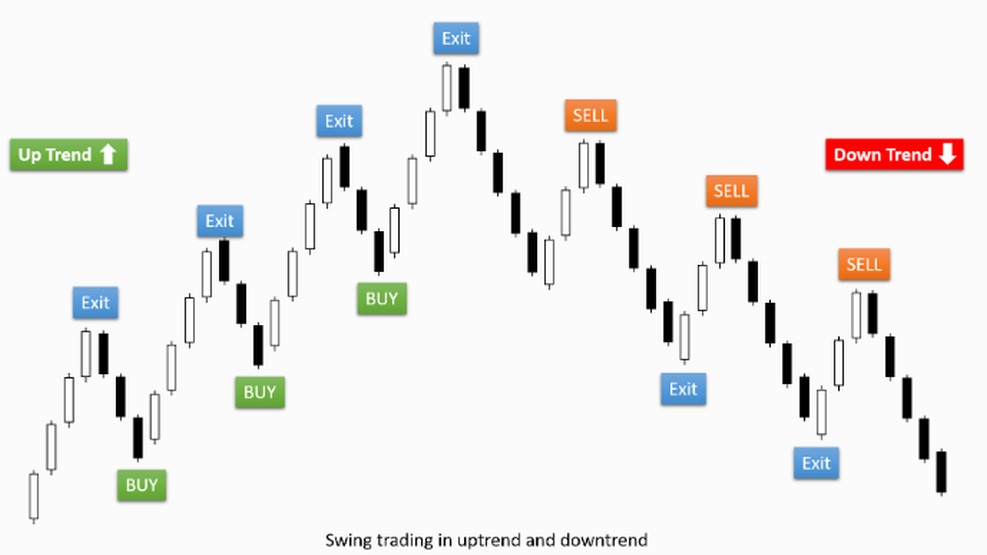

Swing Trader

Swing traders hold their positions for a few days.

Position Traders

Positions are held from a few weeks to several months.

The next question you should ask yourself:

“How do I want to analyze the market and how do I decide on a trade?”

- Technical analysis: Use of charts and technical indicators to analyze price movements of a past currency pair to predict in which direction the price will move in the future.

- Fundamental Analysis: Monitoring of economic data, Indicators and political news that can have an impact on the price of a currency. The economy of a country is always reflected in the price of its currency.

Finally, you determine whether you are a system trader or revocation trader.

- System Trader: A system trader or mechanical trader decides on this- or to get out based on the signals of its indicators. If, for example.B. the stochastic indicator shows that a currency pair is oversold, the system trader will automatically open a long position.

- Revocation Trader: This trading style suits traders who use both types of analysis, technical- and fundamental analysis, use. The technical methods sometimes show good entry opportunities, but fundamental analysis can give a different perspective on the overall state of a currency pair.

Summary of Trader Personalities

Success in FOREX trading requires hard work, a lot of time and some blood, Sweat and tears. New traders should be realistic from the start. Beginners should start small and constantly evaluate your profitable trades, but also the mistakes.

As I have already said, Trading is not like buying a T-shirt, there is not one universal size that suits everyone. Before you can be successful as a trader, you have to do your homework. Identify your own strengths and weaknesses, But you should also set your schedule, Consider trading capital and FOREX experience.

Take the time to answer these questions, and also study your trader diary to see how you behaved in different situations. Only then can you decide which trader personality suits you.