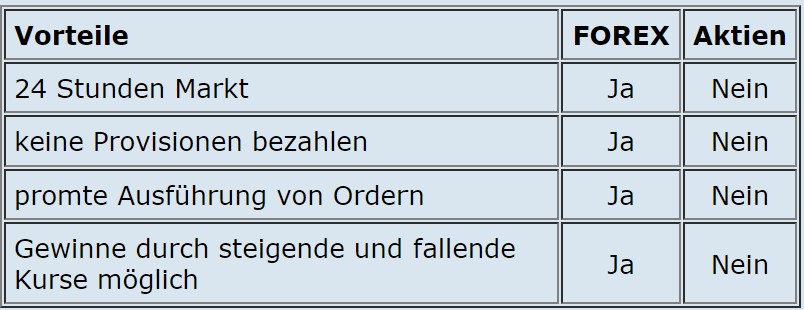

24-Hours market

The FOREX market is 24 Hours open all hours. With most brokers, trading is on 5 Days a week possible, the customer service is at 7 Dawn, 24 Hours available. You can go to American, Trade Asian and European market hours, This allows you to set up your own trading schedule. When trading stocks, you are always bound to the trading hours of the respective stock exchange.

No commissions

Most FOREX brokers do not charge any commission or additional fees to trade currencies online or over the phone. Together with the low and absolutely transparent spreads, the cost of trading foreign exchange is lower than that of any other market. The broker is only supported by bid/ask differences, i.e. the spread, compensated for his services.

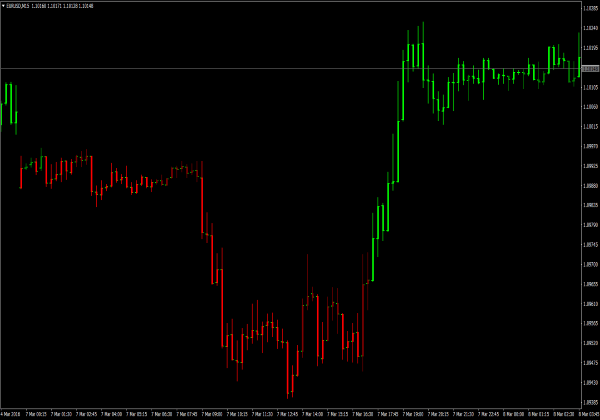

Instant execution of trade orders

Under normal market conditions, all your orders will be executed promptly. You get exactly the price you click on. With real-time streaming, you are always informed about all current courses. There are no longer any discrepancies between the price on your screen and the price at which you open your trade. Delays can occur when there are very strong movements in the market.

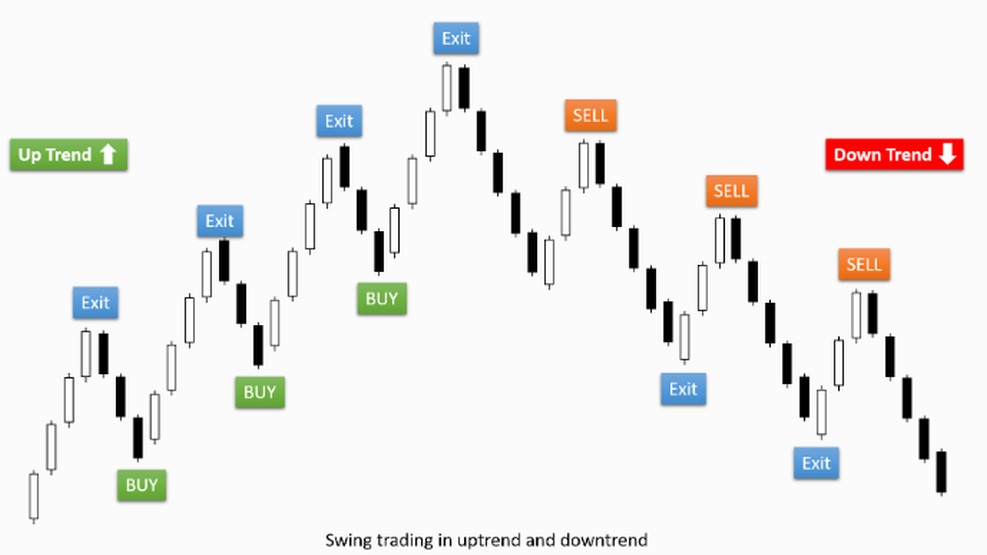

Profits with falling prices

Unlike stock trading, FOREX allows you to make profits even with falling prices. When you buy a stock, you always assume that it will increase in value.. In Forex trading, you have the opportunity to (Long Position) or falling prices (Short Position) to set, depending on where the market is moving. Because FOREX always buys one currency and sells another, there are also no distortions.

More reasons to like FOREX

No middlemen

Trading on the stock exchange certainly has its advantages. However, middlemen are almost always involved., these middlemen don't do anything for free, they cost money. These costs are collected from you as commissions or fees. There are no middlemen in Forex trading. Your broker allows you to trade directly on the market, i.e. exactly where courses are created.

FOREX cannot be manipulated

If you compare companies whose shares are traded on the stock exchange with one of the main currencies of this world, the size ratio is about the same as between a mouse and an elephant. Due to the huge trading volume of up to 4 Trillions of US dollars in one day, no investor, no matter how large, can influence this market in the long term, manipulation is out of the question.

8.000 Shares vs. 4 Majors

On the New York Stock Exchange, approximately 4.500 Shares traded. Again 3.500 Shares included in the NASDAQ. Which of them do you want to buy? Do you have the time to stay on top of so many companies? At FOREX you can of course also trade with many different currencies, However, most transactions between the 4 Major currencies carried out. Are 4 Currency pairs not much easier to overlook than thousands of stocks?

Summary of the advantages of FOREX over stocks

FOREX vs. Futures

Liquidity At FOREX, up to 4 Trillions of US dollars traded daily. This makes the foreign exchange market by far the largest and most liquid market in the world.. This trading volume dwarfs that of any other market.. On the future market, no more than 30 Billions a day, therefore cannot compete with FOREX in terms of liquidity. FOREX is always liquid, specifically. Orders can be executed at any time.

24 Hours market

Once again, you are not tied to any stock exchange in Forex trading.. When important news comes from New York or Japan while the European stock exchanges are closed, the start of the following trading day is often a wild ride. As a FOREX trader, you have an absolute advantage.

No commissions

That is what I want to say, at FOREX you do not pay commissions. Here you can place your order via Internet, firstly, this is convenient and you do not have to pay a middleman. Brokers are compensated for their services with the spread.

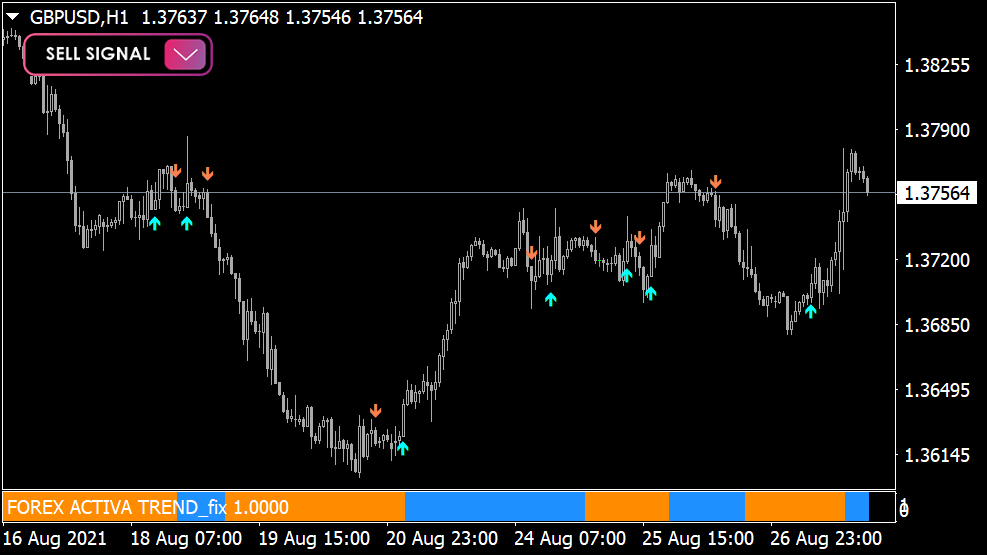

Price security

At FOREX, orders are executed instantly, this guarantees you that you are buying a currency at exactly the same price, where you click Buy. Unfortunately, futures are far from that. The price offered by futures brokers is often that of the last trade and likes to deviate from the price, to which you actually buy.

Limited risk

You can set limits on each order to prevent major losses. Your trading platform automatically executes the desired order at the appropriate time. Open positions can be closed at any time and without delay.

Summary of the advantages of FOREX over futures