Welcome to the primary school. We are looking forward to, that you attend primary school and are ready, acquire extensive knowledge of FOREX trading. The Forex Primary School consists of a total of 81 Topics, which you should work through attentively and occasionally repeat in order to become saddle-proof in all areas.

In any case, we recommend that you create a demo account with a FOREX broker in order to apply your acquired knowledge with play money and gain experience. If you have any suggestions or criticisms about the FOREX school, we look forward to receiving your e-mail. Please use the contact form. The Forex school is intended to become a growing project and if you like to write and expand or supplement a topic, we are happy to receive your suggestions.

Now we do not want to hold you back but send you on an exciting and exciting journey into the FOREX world….

In the first chapter you got to know the basic concepts. You now know how FOREX works, what can influence the market and what you should pay attention to as a beginner.

From here we will talk about how you can make money with FOREX. We will cover all these topics, that you as a treader should know in order to successfully participate in the market. But even if you have worked through all the chapters, your training is not over yet. You must continue to gather knowledge in order to improve your personal conditions, then become the true master of FOREX.

The two types of analysis

There are two basic types of analysis you can opt for:

1. Fundamental Analysis

2. Technical analysis

It is constantly being discussed which type of analysis is the better. To put it in a nutshell, to be really successful, you need a little bit of both. That's why we're going to take a closer look at both of them..

Fundamental Analysis

Fundamental analysis is a method of predicting future movements in the market. This is based on political and economic influences, Environment, as well as a number of other relevant factors and statistics. To put it simply:, You will find out whose economy is developing well and what weaknesses are showing. Because the better a country's economy, the more confidence other countries have in the currency of that country.

The most profitable treads are usually made just before or after important economic announcements. We will take a closer look at the topic of fundamental analysis, then you will learn what kind of news can affect the price of a currency. Until then, just remember, that fundamental analysis offers an opportunity, Predict the price development of a currency by the strength of the country's economy.

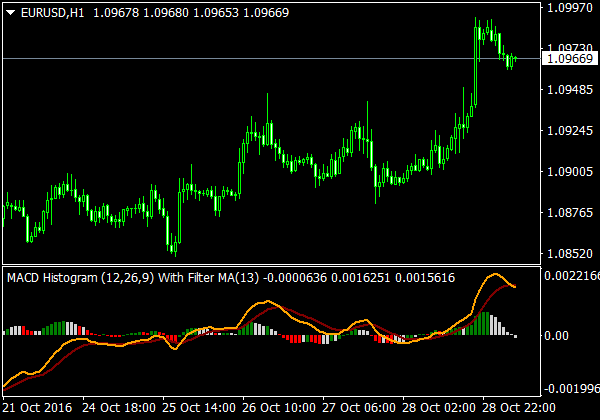

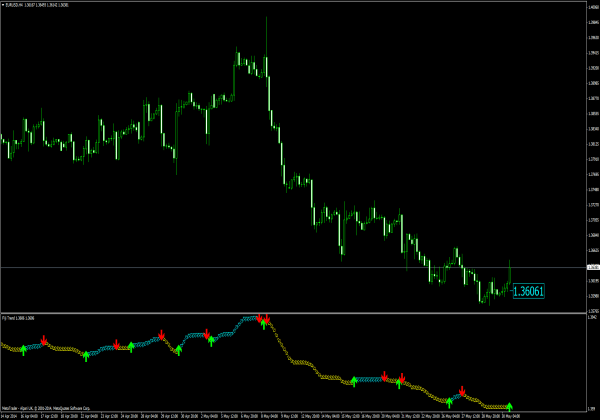

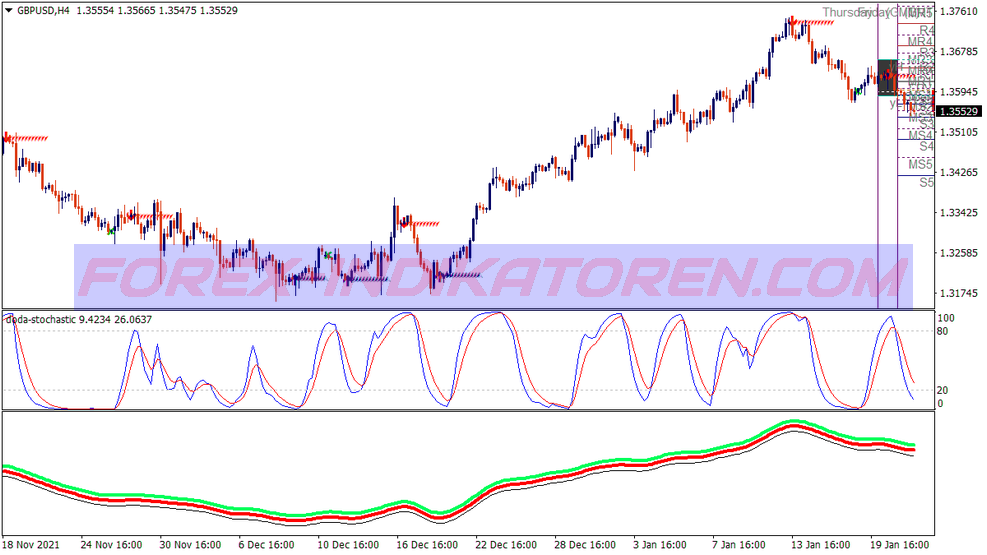

Technical analysis

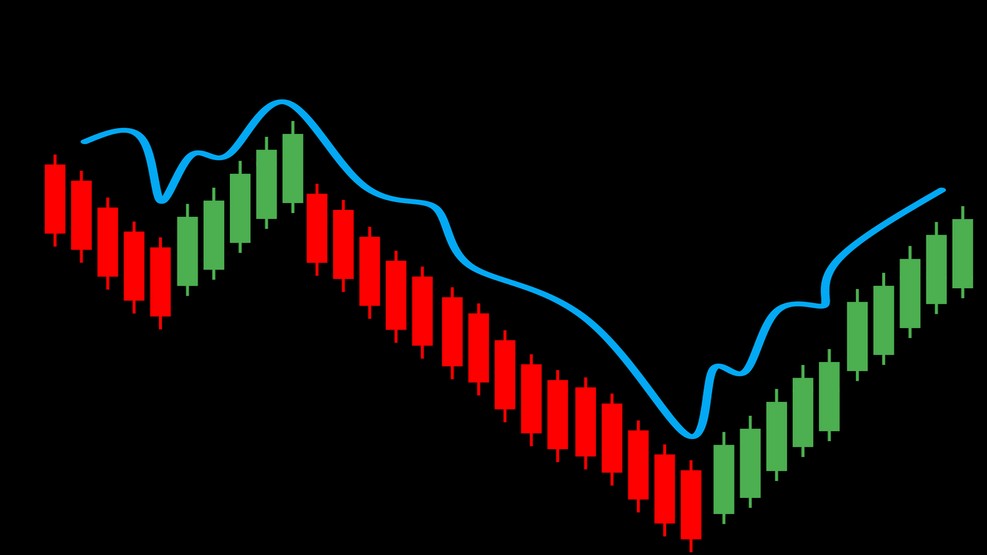

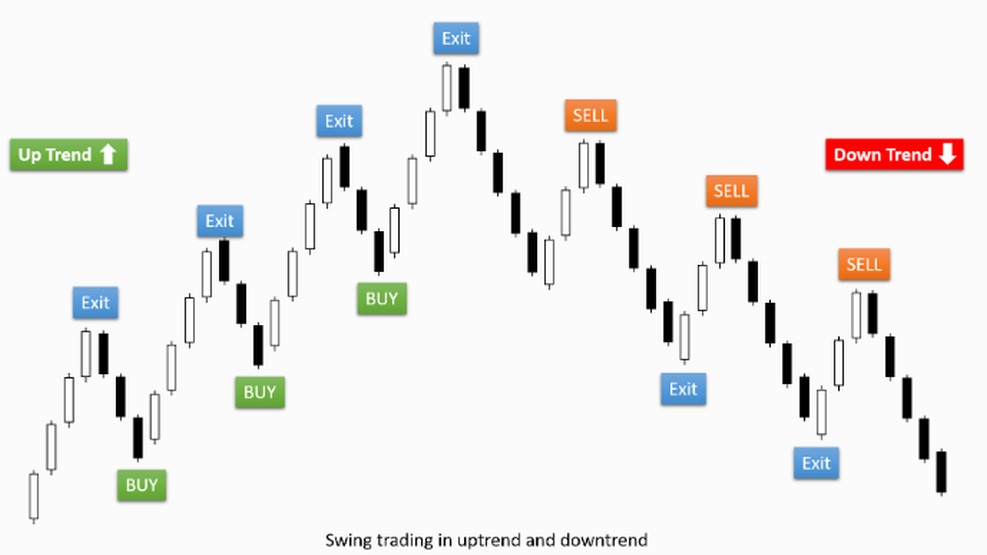

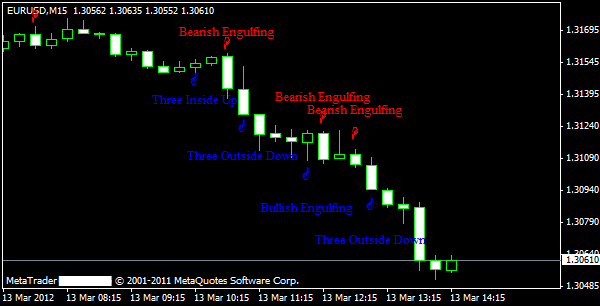

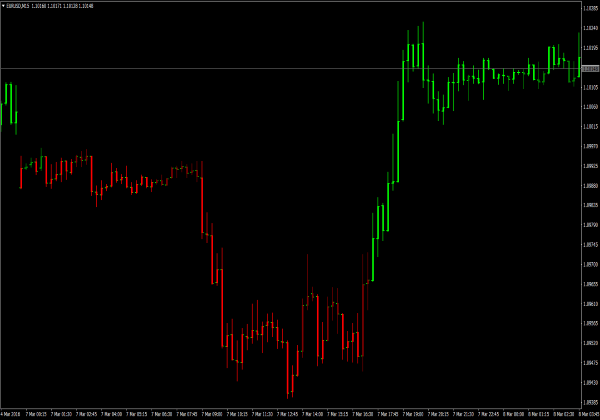

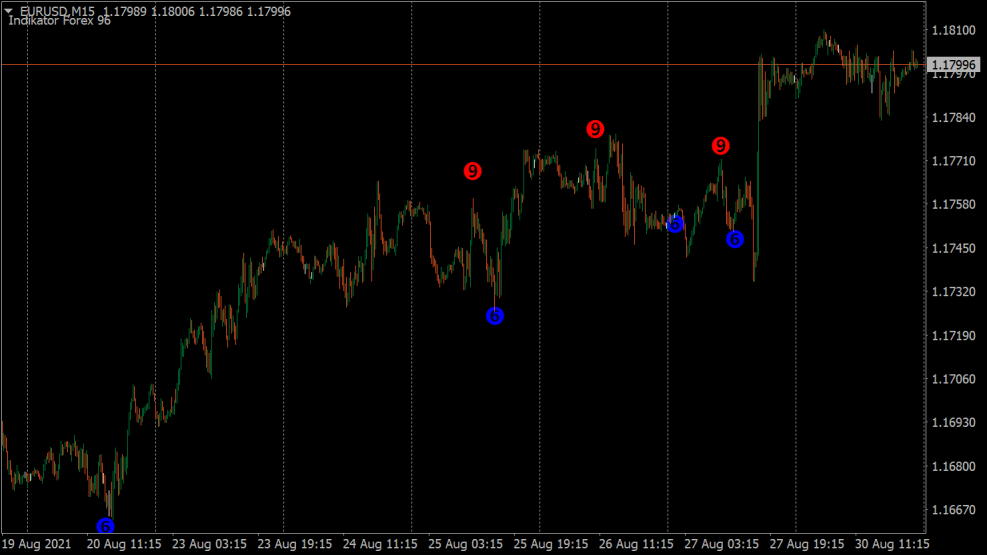

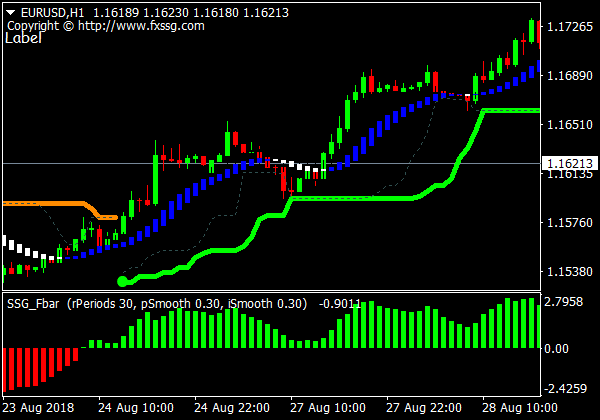

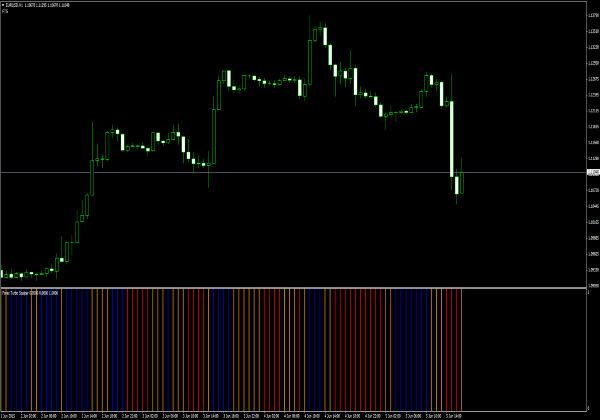

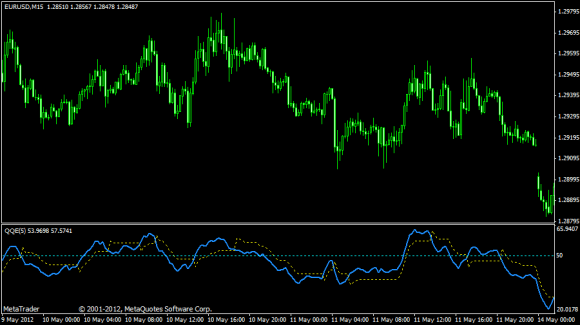

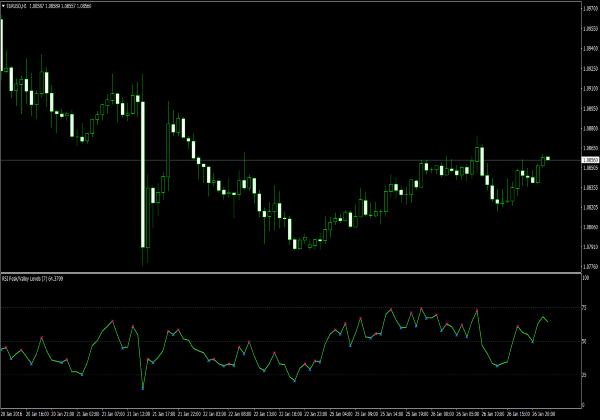

Technical analysis is the study of price movements. The most important tool for this are charts (Diagrams). The idea behind it is, that a trader compares price movements in the past with current price activity and can thus make a prediction for future price developments. When watching charts, you can identify trends and patterns that promise good trading options.

The most important insight of technical analysis is trends. As the saying goes: “The trend is your friend” (The trend is your friend). The reason for this is that, that it is much easier to make money if you recognize a trend and trade in the same direction. Technical analysis helps you to identify a trend at the earliest stage and thus provides you with very profitable trading opportunities.

Which method of analysis is the better?

Would you ask several successful FOREX traders this question?, then you would hear strong arguments for both methods. Some will argue that only the fundamental influences are responsible for the prices in the market and that chart patterns arise purely by chance. On the other hand, those who advise you to rely on technical analysis, because you can recognize known market patterns and thus be able to predict future price developments.

My opinion on this is, that you should not limit yourself to one page. None of the methods is better than the other. To be a really good FOREX trader, you should know how to use both types of analysis to your advantage.

Maybe you can remember how your parents explained to you, that too much of something is never good. The same is true if you choose a method of analysis. Don't rely on just one. Instead, you need to learn, use both methods, to achieve the best trading results.